By: Devin Blitzer

Every Bitcoin miner can contest exorbitant electricity bills come with the territory. As long as the Bitcoin mining equipment produces more bitcoin than the monthly electricity bill, who cares. Bring on those electricity bills.

Out of the 18,000,000+ Bitcoin in circulation today, a majority have been mined at home, paying residential electricity rates. Unfortunately, mining at home is no longer profitable for pay residential electricity rates. Miners, over the past five or so years, have started setting up bigger mines in commercial or industrial parks, paying commercial & industrial electricity rates on the utility grid. Why pay $0.12/kilowatt hour (US residential avg.) when you can pay $0.07/kilowatt hour (US industrial avg.). Yes, the luckiest miners have secured $0.04 or even $0.03/kilowatt hour rates, but it’s rare, takes a lot of time, research and negotiating, and is not a very abundant supply of power for the global Bitcoin mining power demands. Miners are always on the hunt for the cheapest power though, and will locate mining operations anywhere, for example, in Iran or Kazakhstan, if the kilowatt hour rate is cheap enough. However, there are always pros and cons to placing mining operations in various countries.

Let’s break down the 3 main category costs that make up an electricity rate:

- Power Plant (or Generator)

- Fuel

- Transmission and Distribution

Bitcoin mining at the Power Plant is the easiest way Bitcoin miners are shaving electricity rate costs. Residential, commercial and industrial electricity rates include transmission and distribution fees to transmit electricity from the Power Plant to the commercial or industrial facilities. Eliminating these transmission and distribution fees can save tremendously on your electricity bill. And since power plants have excess electricity (depends), it can be fairly straightforward to secure the power they’re not able to sell to consumers for Bitcoin mining.

Cons of powering a Bitcoin mine at a Power Plant is that the Power Plant makes a lot of their money selling power during peak hours, leaving the Bitcoin mine with perhaps 90% uptime or even less. Typically, miners of bitcoin want to be running as close to 100% of the time as possible so as to maximize their profit potential. It’s the Power Plant’s that have minimal peak hours that are the best to target.

The next major cost saver is lowering the fuel costs.

Welcome…. Stranded Gas.

Stranded gas is natural gas that is wasted or unused. At power plants, gas is not stranded, and thus bought at market price. Stranded gas on the other hand is free or heavily discounted, saving as much as 50% on the kilowatt hour cost. Once transmission costs have been eliminated and low fuel costs have been sourced, the main focus becomes optimizing the Power Plant cost in any way possible. Many variables from fuel quality to environmentals to economics can drastically affect how the Power Plant or generator is chosen. Reciprocating engine generators made by Caterpillar, Cummins, Waukesha, Wartsila, and Doosan are common choices for Bitcoin mines in the 100 kWe – 15 mWe range. For larger deployments, gas turbine generators made by Solar, Siemens and General Electric become the most economical power plant solution, due to lower capital expenditure (economy of scale) and lower operating cost over the generator life cycle. Turbines also have a smaller footprint, and can generate up to 25 mWe or more in a single trailer.

Power Plants using stranded natural gas can generate electricity below $0.03 per kilowatt hour, or even lower than $0.02 per kilowatt hour. Just how Bitcoin miners made the movement to commercial and industrial electricity rates, Bitcoin miners are now creating the next movement to stranded gas.

Let’s Dive into Stranded Gas

Stranded gas has become a huge issue for the oil and gas industry, and thus an opportunity for Bitcoin miners.

Most natural gas produced today is associated natural gas, a byproduct that flows out with the oil and is then separated. Natural gas has 1000x lower energy density (0.036 MJ/L) to crude oil (37 MJ/L), making it uneconomical to transport natural gas via truck. Natural gas requires pipeline infrastructure and more pipeline infrastructure than oil. When natural gas pipeline infrastructure for an oil or gas well has not been put in place, likely due to economical or permitting reasons, the well is considered stranded. The well can’t produce since there is no method to transport the natural gas.

Stranded gas scenarios:

- Flared Gas

- Shut In or DUC Wells

- Pipeline Gas

Flared Gas

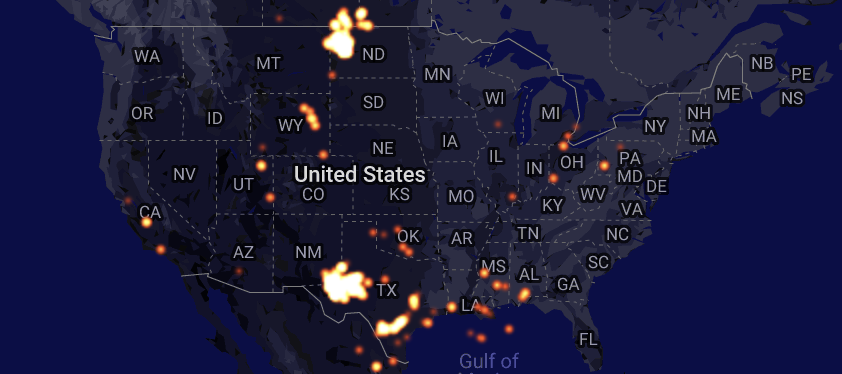

Flared gas is natural gas that is burned into the air due to pipeline capacity. The purpose of burning is to prevent the risk of explosions in the field, by combusting the gas in a controlled environment. Today, the USA flares over 1 billion cubic feet of gas per day, or 96 gigawatts per day. To put it into perspective, that’s enough to power over three million homes. And it’s not just an issue in the USA. Flared gas is an international problem, both environmentally and economically.

Flared gas usually comes in the form of associated gas (oil wells) more often than non-associated gas (gas wells). Associated natural gas is the byproduct of oil wells, and oil is the product upon which oil companies project their investment return. Typically, profits are derived from the oil, not from the associated gas. Non-associated gas wells don’t produce any oil, so with these types of wells, natural gas is the product that requires a return on investment. Burning natural gas from gas wells would burn away the gas well’s profits.

Onshore wells cost between $4.9 million and $8.3 million per well (EIA report). Regardless of whether it’s an oil or gas well, that investment needs a return. Gas prices below $2.00 mmbtu (i.e. $0.02/kwh) becomes no longer economical to drill for, and thus gas wells are not popular drilled at today’s prices. Already-drilled gas wells commonly are shut in. (2nd stranded gas scenario).

In many regions, oil wells are choked back, meaning that the flow rate of the hydrocarbons is restricted due to a certain amount that can be flared per day. By consuming the existing flare gas, producers can unchoke the wells and drill for more oil. Choked back wells are the best flare gas sites to focus on since the Bitcoin mine consumes the existing flared gas and unchoked gas, producing a higher oil flow rate. Choked back wells always have the capability of producing more than what’s currently being flared.

A majority of flared gas sites have lower amounts of gas available, from 5 mcf per day to 300 mcf per day, or 50 kilowatts to 1000 kilowatts of peak power. In areas such as Texas or North Dakota, megawatts and megawatts of Bitcoin mines can be powered at a single site.

The two main benefits of associated gas is that a) it’s free or close to it (i.e. $0.25/mmbtu) and b) monetizing waste energy is also reducing pollution.

Running a Bitcoin mine off flare gas can become a logistical nightmare if not properly planned. Since wells have a fast depletion rate, Bitcoin mines need to move every 6 months to 3 years to a newly producing well far from the depletion curve. Associated gas supplies are unreliable, spread out, succumb to oil producers production, and are hard to condense a lot of megawatts at one location unless in North Dakota or Texas. 50 kilowatts to 1,000 kilowatts (i.e. 10 mcf to 300 mcf) is most common at a single flared gas site. Caterpillar or Cummins engines, the most common generator sets, also cannot run off rich associated gas, so high fuel flexibility, low efficient engines such as Waukesha and Doosan generators are required. Generator sets on wheels for mobility make logistics significantly easier when mobilizing from site to site.

One major risk of flared gas Bitcoin mines is that they succumb to oil prices. Right now, oil prices are so low that areas such as North Dakota have completely shut in their oil wells. Bitcoin mines that have been running off associated natural gas have had to shut down operations. Always have a backup natural gas source.

Shut In Wells

Shut in wells have been drilled but are non-producing wells due to:

- Pipelines that don’t show up. Sometimes projects go south or a midstream company declares bankruptcy or a change in regulations prohibits a project materializing after the producer has sunk cost into drilling and completing wells.

- Drilled but uncompleted wells (DUC). These wells have been drilled to keep leases on the land. As of 2020, there are over 4,000 DUC wells just in the Permian Basin alone. Since the well has already been drilled, the only capital costs is well completion and production equipment.

- Suppressed oil/gas prices. Prices are so low that producers stopped production. This can be either due to the producers choice or can be due to producing oil in the negative. Gas wells are commonly shut in wells.

If Bitcoin miners are well capitalized, shut in oil wells are the best wells to purchase for cents on the dollar. The gas is free and Bitcoin miners only care about breaking even on the oil. Oil profits are just a bonus. Drilling new oil wells is the best method for securing larger quantities of gas for free, capable of producing megawatts to hundreds of megawatts of power for Bitcoin mining.

Pipeline Gas

“Stranded” Pipeline gas is natural gas that is not physically stranded. The gas has made it to a pipeline, isn’t wasted, and is consumed by an end user. Gas prices are so low, and in some areas, negative, that the oil and gas industry regularly refers to it as stranded gas.

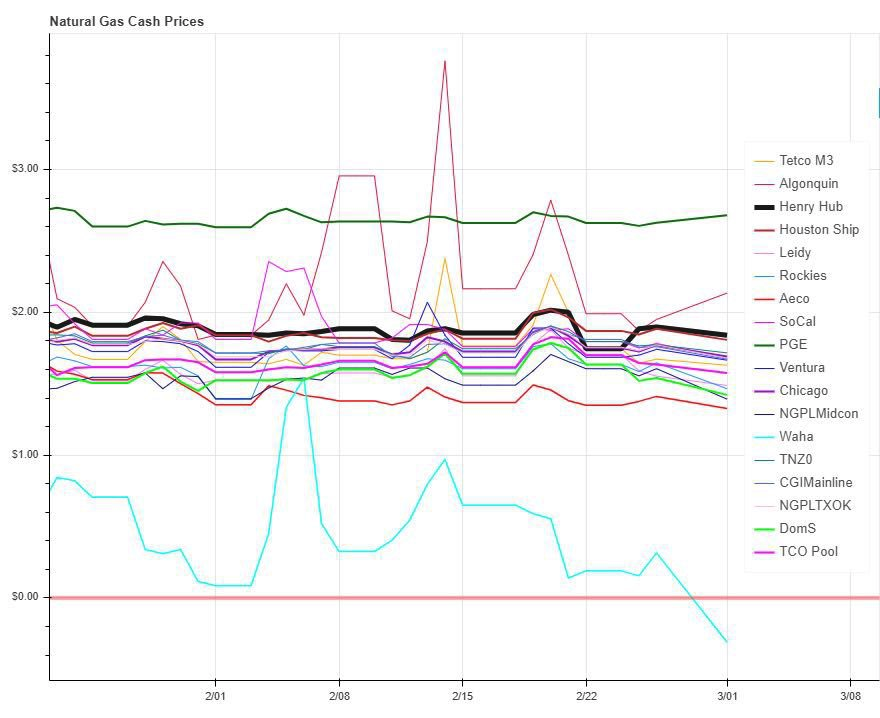

Checkout natural gas prices throughout different hubs. Waha Index (Texas) is in the negative! Oil companies will still produce oil if natural gas is negative because like mentioned before, oil companies make their investment return from the oil.

Pipeline gas Bitcoin mine can be at one location for over 10 years with a reliable gas source. Not needing to move while also having access to more gas supply at a single site

Larger deployments at single site i.e. 25 megawatts, and c) pipeline gas is better for generators. The tradeoff for all these amazing ammentaties is gas is bought at market rates, and locking in fixed price for gas requires credit and/or money down.

Solving Stranded Gas

The energy sector has been trying for over a decade to monetize stranded gas, but the attempts have made negligible impacts.

Here are a few of the popular methods currently monetizing stranded gas.

- Compressed Natural Gas

- Liquified Natural Gas

- Gas to Electricity

- Gas to Methanol

Out of all the ways to monetize stranded gas, Bitcoin is on track to making the biggest impact in 2020 and beyond. Bitcoin mining is an easy way to monetize stranded gas, and the energy sector will forever be linked to Bitcoin. Bitcoin is an energy currency, and it’s about time Bitcoin ties in directly with the energy sector.

I encourage aspiring Bitcoin miners to reach out to friends and family in the oil and gas industry and ask about the stranded gas issues they encounter today. They may have a huge need to monetize their gas, and thus, the opportunity to set up a Bitcoin mine producing electricity lower than $0.03/kwh or even $0.02/kwh!